td ameritrade tax calculator

You can also view whether your positions are categorized as long term or short term. Lifetime Income Illustration Tool.

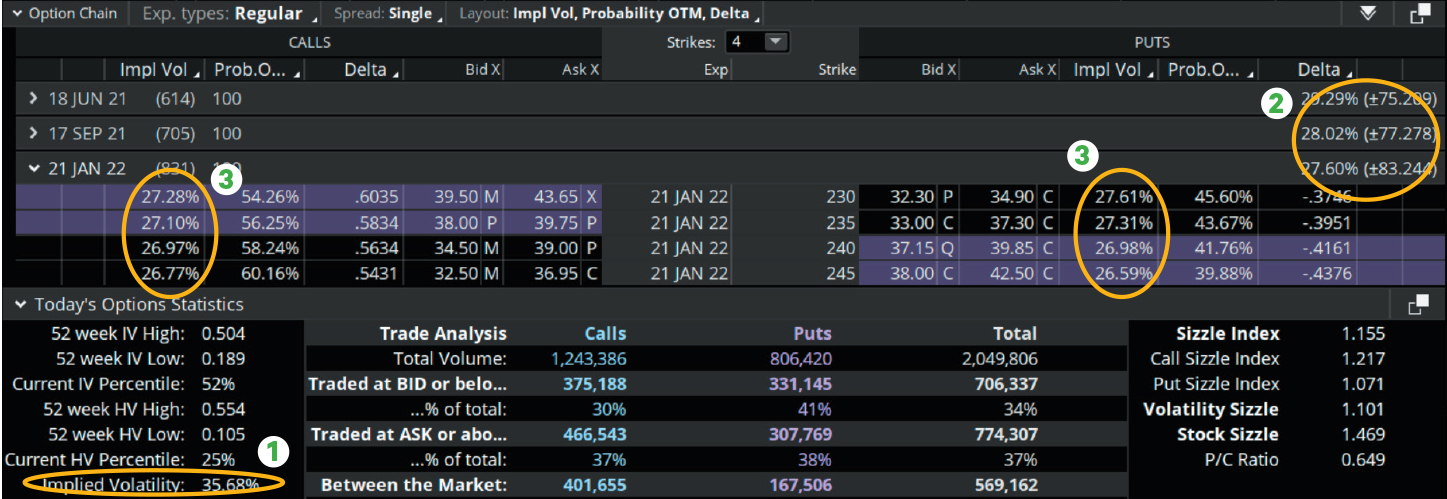

Vol Whisperer So Many Vol Readings Which One Do I Use Ticker Tape

Brokerage services provided by td ameritrade inc member finrasipc and a subsidiary of the charles schwab corporation.

. Routing number wire transfer - domestic. Mark-to-Market Trader Taxes. TEY is only one of many factors that should be considered when purchasing a security.

Ordinary dividends of 10 or more from US. One of the biggest changes in the tax code was a change to the standard deduction which was nearly doubled to 12000 for individuals and 24000 for married couples filing jointly. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties.

The default figures shown are hypothetical and may not be applicable to your individual situation. To import your TD Ameritrade account information into TaxAct. Please consult a legal or tax advisor for the most recent changes to the US.

It shows wash sale information and any adjustments to cost basis when applicable. All Promotional items and cash received during the calendar year will be included on your consolidated Form 1099. Please consult a legal or tax advisor for the most recent changes to the US.

The Premier version and higher calculate wash-sale adjustments. The Realized GainLoss tab lets you filter for a specific time period and displays sells and corporate action events such as mergers and spin-offs see figure 2. Our retirement income calculator determines how much you need to retire based on your current age income and health.

Td Ameritrade Tax Calculator. Greene-Lewis says taxpayers who arent sure how they might file can use a standard-versus-itemized deductions tax calculator to figure out their status. Select your federal tax rate.

Apply to Teller Customer Service Representative Teller Supervisor and more. We suggest you consult with a tax-planning professional with regard to your personal circumstances. TD Ameritrade does not provide tax advice.

Built for Traders by Traders. East Meadow NY 11554. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company Inc.

TD Ameritrade offers tips on how to calculate your income taxes where to find the a helpful income tax calculator the types of deductions you may be eligible for and more. And The Toronto-Dominion Bank. From within your TaxAct return Online or Desktop click Federal on smaller devices click in the top left corner of your screen then click Federal.

Taxes related to td ameritrade offers are your responsibility. Your tax forms are mailed by february 1 st. To see how borrowing works in practice we can use TD Ameritrades margin rates calculator.

You must enter the. On the mobile app balances are shown on the Dashboard tab. Your taxable equivalent yield is Click the Calculate Button.

TD Ameritrade Institutional Division of TD Ameritrade Inc TD Ameritrade Clearing Inc members FINRASIPC. It can be found on the brokers website. Tax code and for rollover eligibility rules.

The completed Legal Transfer Form the original stock certificate s if applicable and supplemental documentation if required may be mailed to the following address for processing. Store Location on Map. Calculate the required minimum distribution from an inherited IRA.

Use our required minimum distribution calculator to estimate the distributions you are required by law to withdraw annually based on your birthdate. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Routing number direct deposits electronic payments.

Get Directions 43 based on 250 votes. Td ameritrade tax calculator. Click the Investment Income dropdown click the 1099 import from institution.

Then I sold one on 11252020 for a gain 130 the other one I sold for a loss -30 on 11272020. Calculate the required minimum distribution from an inherited IRA. Contribution and Eligibility Calculator.

After logging in hover over the My Accounts tab and select Balances. Select your state of residence. The information provided by these calculators is intended for illustrative purposes only and is not intended to purport actual user-defined parameters.

RMD amounts depend on various factors such as the beneficiarys age relationship to the beneficiary and the account. Click TD Ameritrade from the list of financial. 474 Portion Rd Ronkonkoma New York 11779 631 588-1564.

Tax code and for rollover eligibility rules. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties. HR Block installed versions import BuySell.

While the funds cannot remain in a tax-deferred account they can be put into a taxable account. TD Bank Rockville Centre Store Branch 40 miles Full Service Brick and Mortar Office. And foreign corporations capital gains distributions mutual fund dividends federal and foreign tax withheld and.

Depending on your activity and portfolio you may get your form earlier. Trade for a Living. For detailed hours of operation please contact the store directly.

On the thinkorswim app there is a Balances icon underneath the More tab in the. View Map Use Map Navigation. This TEY calculator is intended to be used only as a general.

The wash sale rule prohibits an investor from taking a tax deduction if they sell an investment at a loss and repurchase the same investment or a substantially identical one within 30 days. SWIFT Code BIC. Discover Helpful Information And Resources On Taxes From AARP.

Be sure to consult a financial professional prior to relying on the results. Broadridge Corporate Issuer Solutions. Enter the yield to maturity or yield to call of the Municipal bond.

TD Bank in Ronkonkoma NY 11779. TD Bank New York Medford 1806 Medford Avenue Route 112 Routing number and SWIFT Code. To import your TD Ameritrade account information into TaxACT follow the steps below.

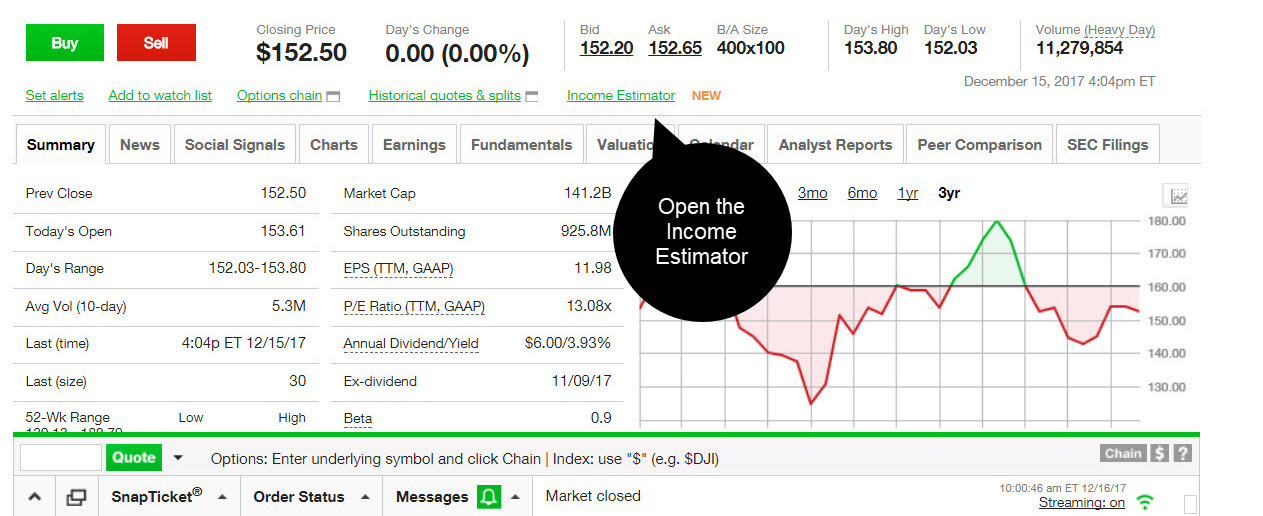

Whats My Potential Income The New Dividend Income E - Ticker Tape. And The Toronto. All Promotional items and cash received during the calendar year will be included on your consolidated Form 1099.

The installed version is recommended by our partner GainsKeeper. The new Income Estimator tool shows you various data points for dividend stocks and ETFs such as. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company Inc.

Figuring out what you owe in income taxes might seem daunting but there are ways to make it easier. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company Inc. The tool also lets you look back at a companys historical dividend payments to see if theres a trendwhether positive or negativein.

The Best Retirement Calculator Review I Review 26 In One Day Calculatormountain Chief Mom Officer Retirement Calculator Cnn Money Retirement

Td Ameritrade Essential Portfolios Review Smartasset Com

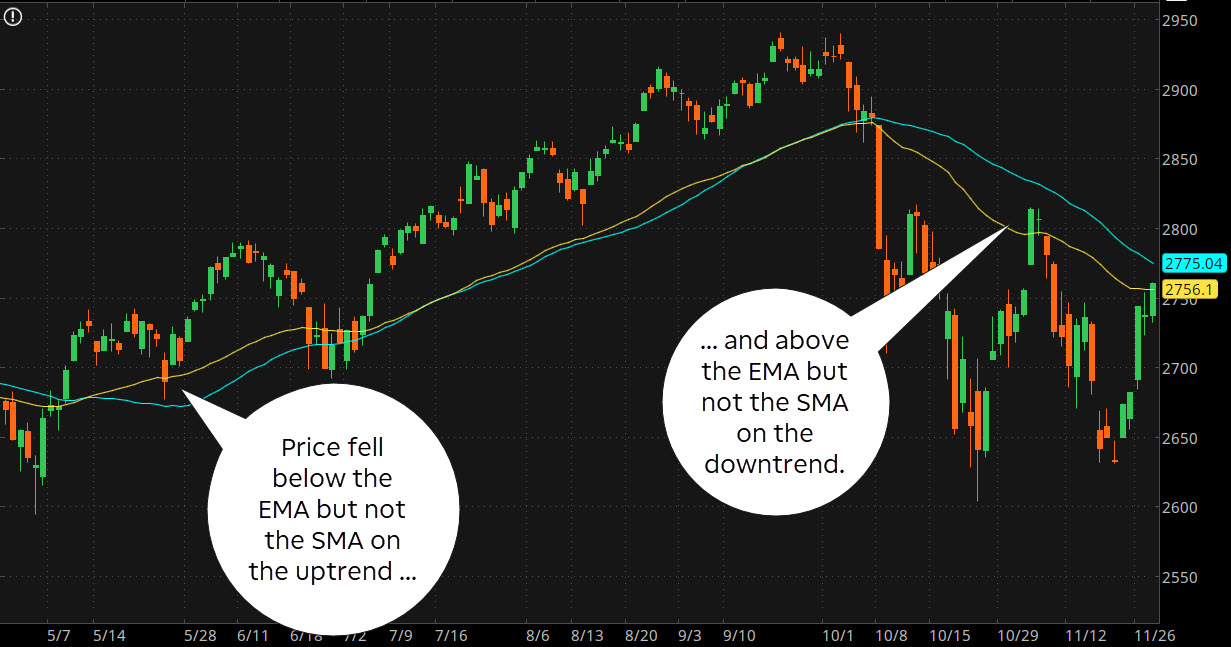

Indicator Throw Down Simple Vs Exponential Moving A Ticker Tape

What S My Potential Income The New Dividend Income E Ticker Tape

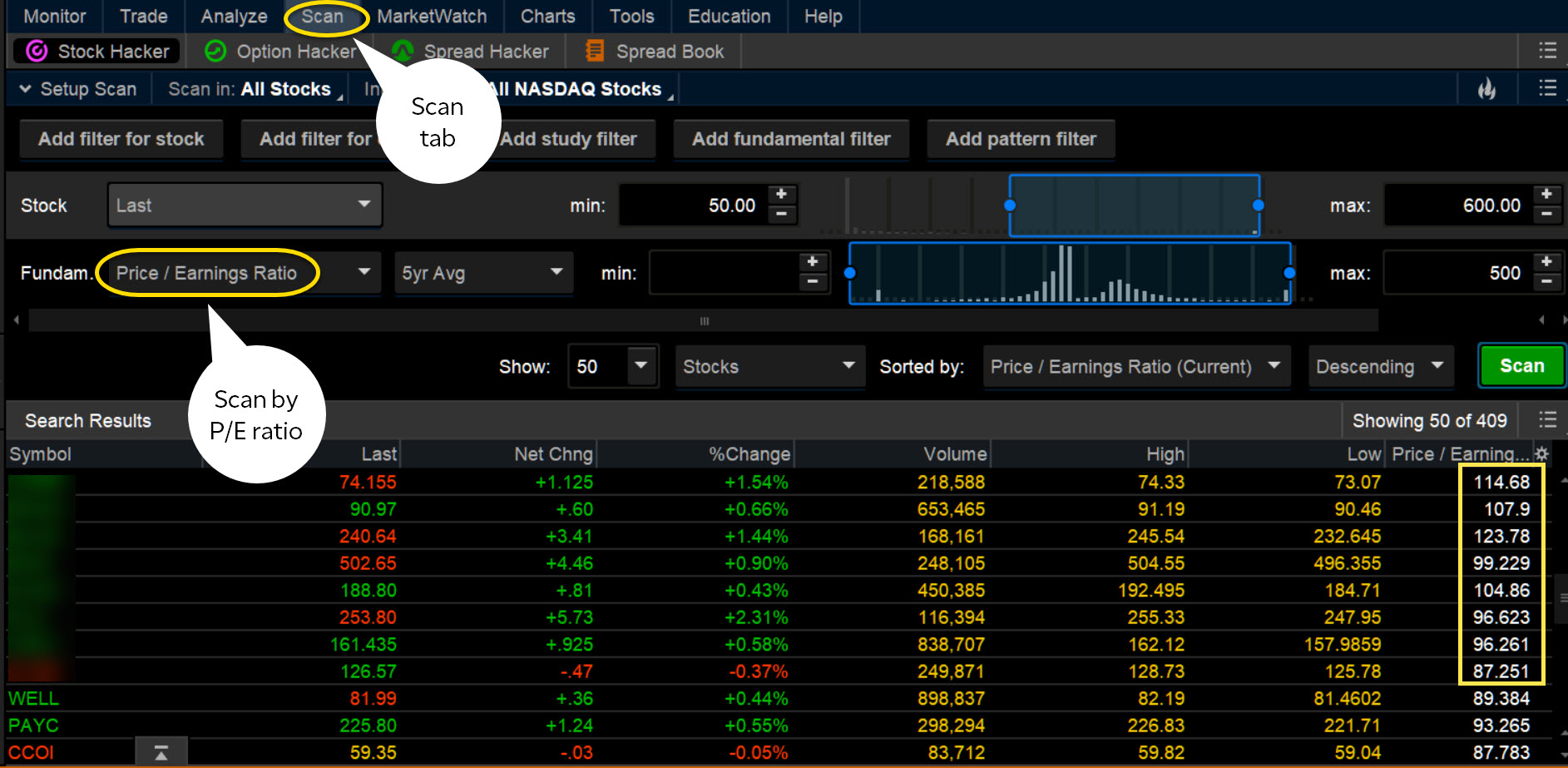

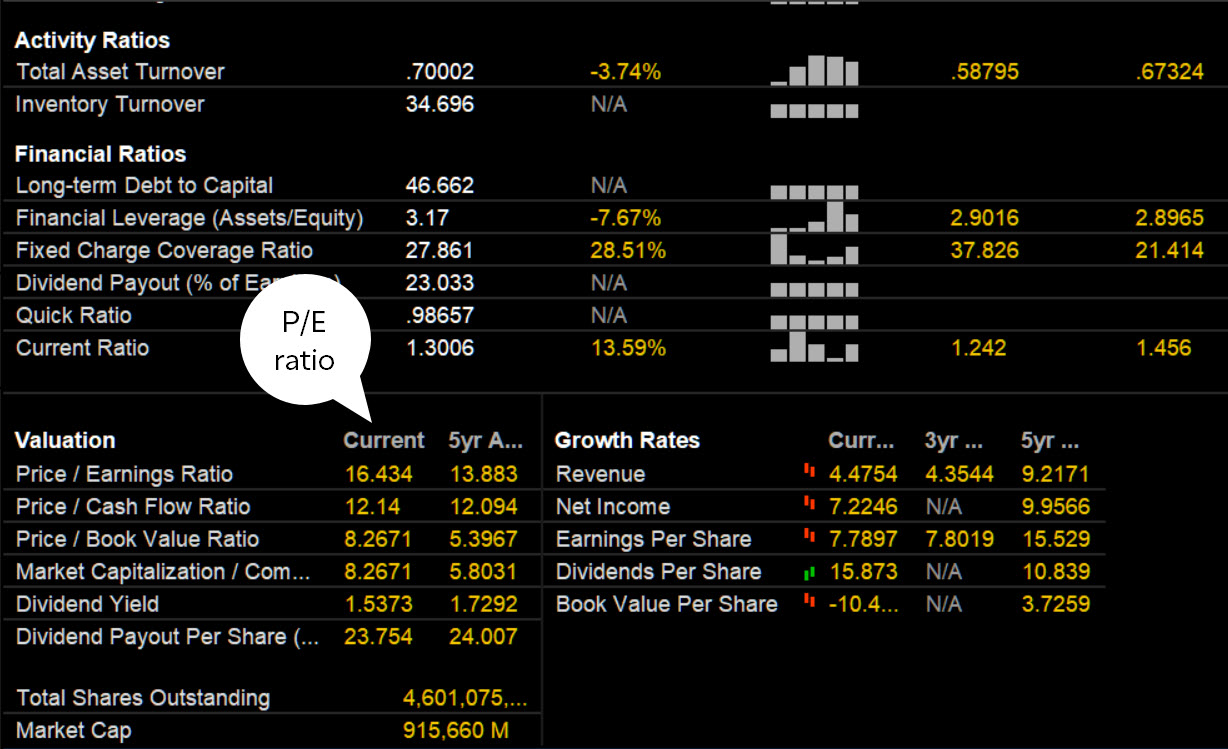

Price To Earnings Ratio The Price Is Right Right Ticker Tape

33 Free Investment Tracking Spreadsheets Excel ᐅ Templatelab

Free Stock Trading Td Ameritrade

What S My Potential Income The New Dividend Income E Ticker Tape

How To Fix Thinkorswim S Delayed Data And Get Real Time Data For Free

Price To Earnings Ratio The Price Is Right Right Ticker Tape

A Forex Profit Calculator Can Help Calculator Forex Profit

Don T Get Blindsided The Importance Of Tax Return Es Ticker Tape

Using The Average True Range Atr Indicator In Your Ticker Tape

How To Fix Thinkorswim S Delayed Data And Get Real Time Data For Free

What S Hot And What S Cool Ticker Tape

Calculating Regulatory Aum Vs Assets Under Advisement Aua Regulatory Asset Management

Tax Efficient Fund Placement Bond Funds Fund Accounting Corporate Bonds

/Robinhoodvs.TDAmeritrade-5c61bba946e0fb0001587a6f.png)